Taking control of your finances can seem daunting, but with a clear plan and consistent effort, you can eliminate debt and pave the way for a brighter financial future. This step-by-step guide provides practical strategies to help you conquer your debt and achieve lasting financial freedom. First, it's crucial to assess your current situation by listing all your debts, including the balances, interest rates, and minimum payments. Next, develop a realistic budget that allows you to distribute funds effectively towards debt repayment. Explore various debt repayment strategies, such as the snowball or avalanche method, to find one that suits your needs.

- Dedicate yourself to making consistent payments on time.

- Consider professional help from a financial advisor if needed.

- Stay focused and motivated throughout the process.

Remember, conquering debt is a marathon, not a sprint. Commemorate your progress along the way and never lose sight of your ultimate goal: financial freedom.

Escaping Free From the Chains of Debt

Debt can feel like a heavy encumbrance, trapping you in a cycle of stress. But you don't have to remain chained by its hold. With commitment, you can escape its clutches and secure financial autonomy.

It starts with understanding your current position. Create a comprehensive budget to record your earnings and costs. Identify areas where you can trim spending and allocate funds towards payoff.

Consider enlisting help from a credit counselor. They can suggest tailored advice based on your unique circumstances.

Remember that development takes time and consistency. Celebrate your successes along the way to remain encouraged. With a organized approach, you can conquer debt and embark on a path towards financial security.

Debt Management for Prosperity

Effectively tackling debt is a fundamental step towards achieving financial success. A well-crafted system can help you reduce the weight of indebtedness and establish a solid foundation for your personal future. One reliable strategy is the snowball method, where you focus on settling your smallest debts first. This can provide a sense of accomplishment and motivation to remain steadfast on your path.

Another method is merging your debts into a combined loan with a smaller interest rate. This can streamline your payments and minimize money on interest charges over time. Consider that developing a budget is essential for debt management. Monitor your revenue and costs to recognize areas where you can save money.

By implementing these strategies, you can gain control over your debt and work towards a more financially secure future.

Achieving Financial Freedom: The Path to Being Debt-Free

Embarking on the quest to financial freedom can seem challenging, but with a strategic plan and unwavering dedication, becoming debt-free is within reach. The key lies in developing healthy money strategies and regularly working towards your aspirations.

- Initiate by creating a feasible budget that distributes your income judiciously.

- Identify areas where you can cut back on outlays.

- Consider different methods for eliminating your debts, such as the avalanche method.

Remember that wealth freedom is a process, not a sprint. Continue driven by your aspiration of a debt-free future, and appreciate each milestone along the way.

Dominate Your Money: A Debt Elimination Plan

Are you smothered by credit card balances? Don't allow it to dominate your life. You can reach financial stability with a well-structured debt elimination plan. Start by creating a detailed budget that tracks your income and expenses. Pinpoint areas where you can cut spending and channel those dollars towards paying off your debt.

- Consider different strategies, such as the snowball or avalanche method.

- Negotiate with your financial institutions to possibly lower your interest rates or research merging options.

- Remain persistent to your plan and applaud your achievements along the way.

Remember, conquering debt takes time and discipline. With a solid plan and unwavering effort, you can achieve financial well-being.

Break Free from Debt

Struggling with financial obligations? You're not alone. Many people find themselves overwhelmed by loans. But the good news is, it's possible to get rid of debt and achieve financial freedom. By implementing proven strategies, you can take control of your finances and build a brighter future. Start by creating a thorough financial roadmap to track your income and expenses. Identify areas where you can save money. Consider seeking payment arrangements to lower your interest rates or monthly payments. Remember, consistency is key. Stay committed to your plan, and celebrate your progress along the way.

- Look into consolidating your debts for simplified payments.

- Seek professional guidance from a financial advisor.

- Create a safety net to prevent falling back into debt.

With dedication and the right tools, you can secure your financial well-being. Don't let debt control your life any longer. Take action today and start your journey toward a debt-free future.

Gaining Masterful Control Over Debt: Simple Steps to Financial Stability

Debt can feel like a heavy burden, but it doesn't have to dominate your life. By taking calculated steps, you can gain the upper hand your financial well-being. Begin by creating a comprehensive budget to track your income and expenses. Identify areas where you can cut back spending and direct those funds towards paying down debt.

- Focus on high-interest debts first to limit the overall burden of borrowing.

- Explore various debt repayment options, such as balance transfers, which can simplify your financial situation.

- Consult professional guidance from a certified financial advisor to develop a personalized debt repayment plan that suits your specific needs.

Remember, reaching financial stability is a ongoing journey. Stay committed, acknowledge your progress along the way, and always give up on your financial goals.

Dominate Your Debt: The Ultimate Guide | To | For Getting Out of Debt

Are you swamped by debt? Don't fret! This comprehensive guide is here to assist you with the knowledge and tools to escape your financial challenges. We'll explore proven methods to analyze your spending, haggle with creditors, and build a solid financial plan. Get ready to restore financial stability!

- Understand your debt: Identify all your debts, including interest rates and minimum payments.

- Develop a budget that fits: Monitor your income and expenses to expose areas where you can cut costs.

- Prioritize high-interest debt: Consolidate debts or explore balance transfer options to minimize interest payments.

- Maximize your income: Consider side hustles, freelance work, or part-time jobs to acquire extra cash.

- Find professional guidance: Don't hesitate to speak with a financial advisor for personalized advice.

Debt Doesn't Define You: Reclaim Your Future

Don't let debt overwhelm your life. It's easy become consumed by hopeless, but remember, what's ahead is totally in your hands. Debt debt free may be a obstacle, but it doesn't have to dictate your story. You have the power to take control and build a brighter future, one step at a time. Forge a plan, establish goals, and take action.

It's a journey that requires dedication and commitment, but the payoffs are immeasurable. You can triumph over debt and realize your dreams.

Adopt a positive mindset, find support via trusted people, and ever give up. Your strength will guide you.

Achieve True Financial Well-being Through Debt Freedom

Unlocking a life of financial freedom starts with taking control of your liabilities. Unmanageable debt can cast a shadow over your finances, hindering your ability to achieve your goals. By implementing a solid plan to pay off your financial burdens, you pave the way for true financial wellness.

- A debt-free lifestyle provides greater peace of mind and stability.

- You can redirect your funds towards investments, building a secure financial future.

- The psychological benefits of being debt-free are immeasurable.

Thrive A Life Without Debt: Achieve Your Dreams

Dreaming of financial sovereignty? It all starts with making a conscious choice to live a debt-free life. While it might seem daunting at first, remember that every step you take towards this goal brings you closer to achieving your dreams. By creating a budget and sticking to it, you'll gain control over your finances and free yourself from the burden of payments. Imagine the benefits that await when you no longer have to worry about debt hanging over your head. You can finally pursue your passions, grow your wealth, and build a secure future for yourself and your loved ones.

- Begin by evaluating your current financial situation and identifying areas where you can cut back on spending.

- Explore different debt repayment strategies to find one that works best for you.

- Make a commitment to living within your means and avoiding unnecessary expenditures.

Remember, living debt-free is not about deprivation; it's about autonomy. It's about taking control of your finances and creating a life filled with joy.

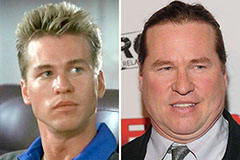

Val Kilmer Then & Now!

Val Kilmer Then & Now! Jennifer Love Hewitt Then & Now!

Jennifer Love Hewitt Then & Now! Tiffany Trump Then & Now!

Tiffany Trump Then & Now! Marcus Jordan Then & Now!

Marcus Jordan Then & Now! Traci Lords Then & Now!

Traci Lords Then & Now!